No longer a rumor, there is a 99% chance that Qualcomm will close the deal with Intel!

The US media has been continuously reporting that chipmaker Qualcomm has approached Intel in the past few days and made a takeover offer when the company’s financial situation is getting worse, and it seems that choosing to “lose itself” may be the most feasible option at the moment. How is it going? Let’s take a look at some of the most notable news about this shocking acquisition in the technology world with Sforum!

Specifically, according to the Wall Street Journal and CNBC, Qualcomm has approached Intel with a takeover offer, and the newspaper also said that a “number” attractive enough will definitely get a nod from Intel in this deal! While the talks are still in the exploratory phase and have not yet begun to negotiate and set terms, we think any deal would have huge implications for the entire technology industry at this time. Furthermore, given Intel’s prestige and size, any takeover deal would likely attract antitrust scrutiny from regulators, as Qualcomm’s future as a “one-man show” in the semiconductor market is now a reality. It is also possible that even if Qualcomm were to take over Intel, the company would still be forced to sell off its businesses to others to create market balance.

As a result, Intel is now planning to spin off its foundry division into a separate subsidiary, which would create much-needed distance between Intel’s chip design and manufacturing capabilities and could be crucial in attracting more customers.

In addition to other steps Intel announced to save $10 billion in costs, the company has paused construction at its factories in Poland and Germany for two years and delayed the start-up of a new advanced packaging plant in Malaysia by adjusting its start-up to “market conditions.”

In addition, Intel has implemented about half of its announced layoff plans, which will see about 15,000 employees leave the company by the end of 2024. The company also plans to reduce its global real estate footprint by about two-thirds by the end of this year.

Importantly, Intel continues to move forward with its projects in Arizona, Oregon, New Mexico, and Ohio. This would ensure continued support from the CHIPS Act, including $3.5 billion in federal funding under the Department of Defense’s “Secure Enclave” initiative.

Finally, contrary to previous rumors, Intel has reaffirmed its support for bringing its FPGA division, Altera, to the public market. However, it remains to be seen how Intel’s latest turnaround strategy will affect its reported negotiations with Qualcomm.

If true, it would be one of the most high-profile and largest tech acquisitions of the decade, comparable to Elon Musk’s Twitter/X acquisition!

Once a dominant force in the semiconductor industry, Intel, which has existed for five decades, is now facing one of its worst periods as losses mount at the contract manufacturing unit it is building in hopes of challenging TSMC (2330.TW).

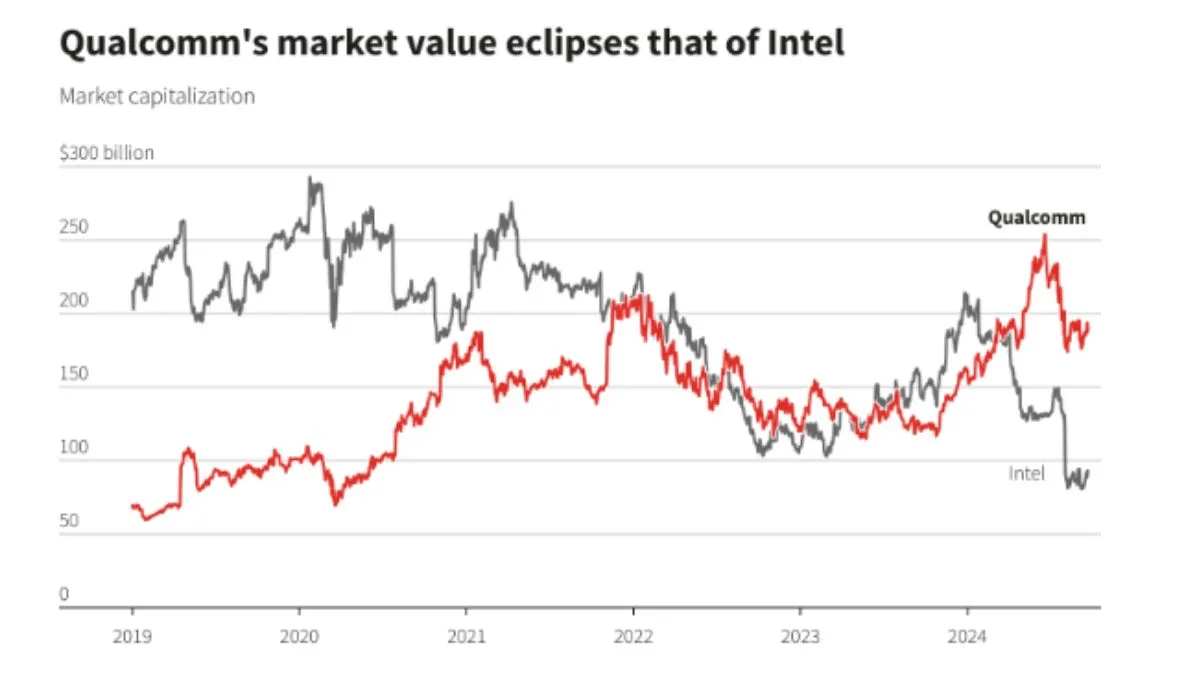

Intel’s market cap has now fallen below $100 billion for the first time in three decades as the company missed out on the generative AI boom after turning down an investment from OpenAI. As of its last close, its market cap was about half that of Qualcomm, which was worth about $190 billion.

Qualcomm had about $7.77 billion in cash and cash equivalents as of June 23, according to its financial report, and analysts expect the deal to be funded largely through stock and would be highly dilutive for Qualcomm investors, potentially raising some concerns.

Qualcomm, which also supplies Apple, has accelerated its efforts to expand beyond its core smartphone business with chips for industries including autos and PCs under CEO Cristiano Amon. But the company remains heavily reliant on the mobile market, which has struggled in recent years due to a drop in demand following the pandemic.

Concerns about semiconductor manufacturing

While Intel designs and manufactures chips that power personal computers and data centers, Qualcomm has never operated a chip factory. It uses contract manufacturers such as TSMC and designs and other technology from Arm Holdings.

Analysts say Qualcomm lacks the experience needed to boost Intel’s fledgling semiconductor business, which recently picked Amazon.com as its first major customer.

Intel’s chip business is seen as crucial to Washington’s goal of growing domestic chip manufacturing. The company has secured about $19.5 billion in federal grants and loans under the CHIPS Act to build and expand factories across four U.S. states.

Some analysts say Intel wants to invest outside rather than sell, pointing to a recent move to make its foundry business more independent. Bloomberg News reported over the weekend that Apollo Global Management, which is a partner at Intel’s Ireland facility, has offered to invest up to $5 billion in the company.

Qualcomm may also decide to buy a portion of Intel’s business, rather than the entire company as previously rumored. You can read more in my previous article on this topic on Sforum!

And as mentioned above, this billion-dollar acquisition is facing many issues related to antitrust and national security, as well as concerns about taking over the semiconductor manufacturing division – a segment that Qualcomm has no previous management experience.

However, for those who are passionate about technology news, this will certainly be an extremely exciting story for us to “look forward” to the next developments on the other side of the hemisphere.